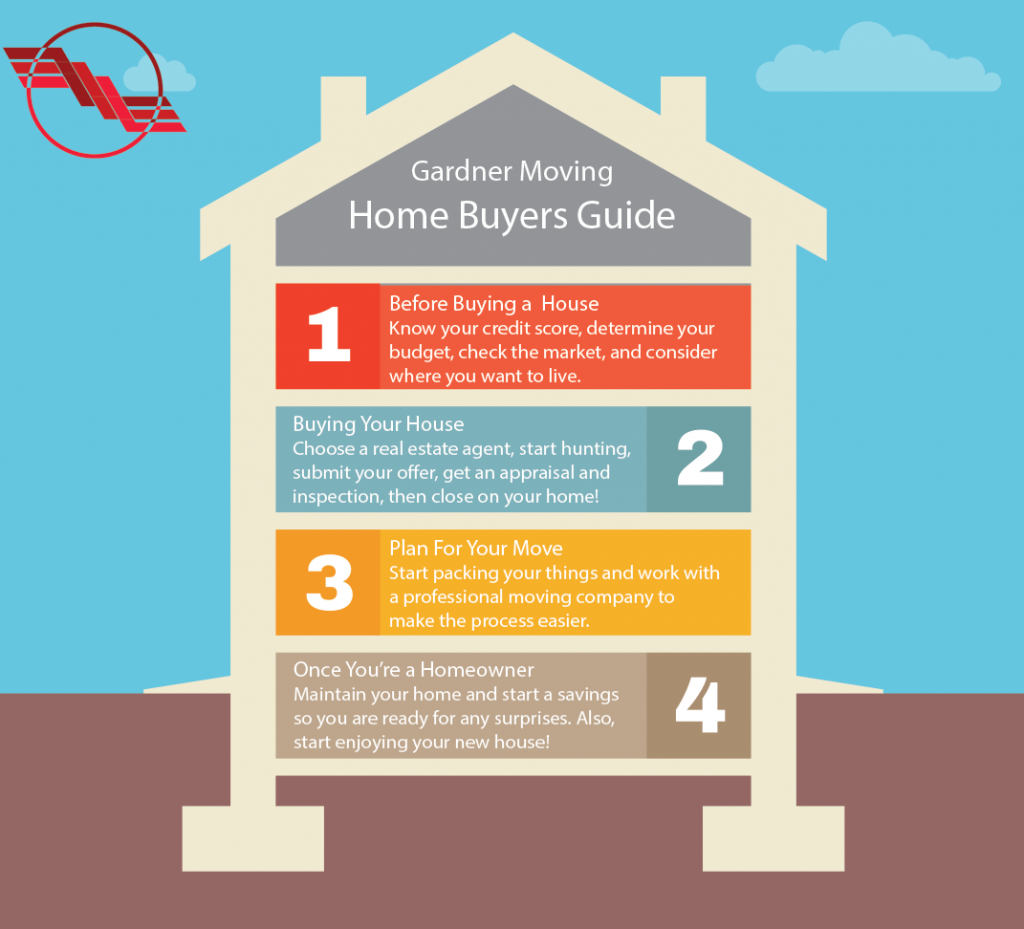

Buying your first home is an exciting time. The best way to make the process easier on yourself is to be prepared. At Gardner Moving, we have put together some tips and tricks you need to know when buying your first home.

From your credit score to your options for a down payment on your new home, there are a variety of things you need to consider before purchasing your first home.

While you may not think about this three-digit number often, your credit score plays a major role in the home buying process. Your credit score will determine whether you can obtain a mortgage and affect the interest rates you qualify for. Learn your credit score to get an idea of where you stand with lenders and whether you will need to improve your score before applying for a mortgage.

A higher credit score will help you get lower interest rates on your mortgage.

Your down payment is the cash you pay upfront for the purchase of your home. Lenders offer various mortgages with varying down payment requirements. Many states, counties, and cities offer first-time homebuyer’s programs that combine mortgages with low-interest rates with assistance with down payments and closing costs.

Be sure to research your state or city’s programs to see what options you have for assistance and how much you will need a down payment to ensure you are prepared.

When shopping for a home, you will want to keep your housing expenses no more than 28% of your gross monthly income. The monthly payment for your property taxes, mortgage, and homeowners insurance should not cost more than that.

You also need to consider your debt-to-income ratio (DTI) when determining what you can realistically afford. DTI is determined by what portion of your gross monthly income goes toward paying your debt obligations, including housing costs, student loans, car loans, credit card payments, etc. 36% or lower is considered a good DTI for qualifying for a mortgage. A lower DTI is better, making it easier for you to budget for emergency expenses and for helping you compare home loans.

Before you start touring homes, make sure you apply for a mortgage preapproval with a few lenders. A preapproval letter will show you the lender’s offer of what they are willing to loan you under certain terms. You can compare these offers to find the lowest fees and rates.

Take the time to consider different areas and neighborhoods. Each place has its own personality, so think about how you want to live. Consider how far your commute to work will be, what type of amenities are close by, and whether you want to be close to the city or in a quiet suburban area.

As you are preparing to purchase a house, be sure to browse listing websites and check the market reports provided by your local real estate agencies. This will help you learn more about the demand for homes, the inventory of properties available to buy, and the home prices in the area.

This information will help you better understand the pricing and the competition you may face when making offers to the sellers.

There are various options for every budget, from detached, single-family homes and townhomes to condominiums and manufactured homes. When browsing for a home, think about your budget and lifestyle to find the right home for you.

While you are searching for the best mortgage rates, be sure to start thinking about your move. When planning your move, you may need to clear out your previous home’s belongings and keep them in a storage unit. You can get a head start on your move by placing items and extra housewares that you won’t immediately need for your move into storage. This will allow you to organize and prioritize your items for a smoother moving process.

Gardner Moving provides professional moving services and assists you with moving your items into storage, and when you are ready, we can help you move the items into your home.

Finding the right home is a process that takes time and patience. It is crucial not to jump into looking for homes or scheduling home tours until you know what you can afford.

To buy your home the right way, you will need to plan and prepare. Saving for the down payment, closing costs, and other moving expenses is a very time-consuming task, so the sooner you begin, the better.

For a down payment, it is recommended that you put down at least 10%. 20% is ideal, so you can avoid private mortgage insurance (PMI). This is an additional cost added to your mortgage that does not go toward paying off your balance.

It is also recommended that you save bout 3% of the home’s purchase price. This will help you cover the prepaid and closing costs. This percentage may vary depending on the cost of fees and taxes in the area. Prepaids will cover any of your prorated property taxes and insurance items, whereas the lenders and title companies charge the closing costs.

Your moving expenses will vary based on how far you are moving from your current home and how much stuff you need to move. These expenses can range from hundreds to thousands of dollars. Be sure to call around to moving companies in your area to get quotes prior to your move. Gardner Moving can provide you with a quote for moving your items.

Once a lender has preapproved you, you can begin looking into mortgage options to see what will work best for you. Getting the right mortgage is crucial to avoid turning your asset into a liability. A few things to consider when it comes to choosing a mortgage:

Choose a 15-year term – While your mortgage payment will be higher, you can pay off the mortgage faster, rather than paying for a 30-year term. This will also save you thousands in interest.

Go for a fixed-rate conventional loan – This option provides you with a fixed interest rate for the life of the loan. This will protect you from rising rates.

Keep the monthly payment at 25% of your pay – You want to try to get your mortgage payment to be around 25% or less of your take-home pay to leave room in your budget for home repairs, saving for your child’s college fund, your retirement, etc.

Having the help of a real estate agent is crucial when searching for a home. They will advocate for your best interest throughout the buying process, and in most cases, the seller pays their fees, so you don’t have to worry about the cost to pay a real estate agent. Look for a real estate agent who has:

Now that your finances are figured out and you’ve chosen a real estate agent, it’s time to start looking for a home! Before searching, make a list of must-haves for your home. Do you need a fence for your dog? Three bedrooms to accommodate your spouse and kids? A large basement for storage, etc.? This list will help you and your real estate agent set realistic goals to find homes with these features in your budget. When looking at homes, consider:

Look beyond the surface – You may hate the color of the bathroom, but if the home checks all the features you want off the list, don’t let things like paint color stop you. The right home for you may need some paint and decor updates, but it does not mean it’s not a great fit!

Location and layout– These are the two things you cannot change about a home. So if you do not like the neighborhood or the home’s layout, it is best to look elsewhere.

Check the home values in the area – Look to see if they are rising or declining. Also, make a note of whether businesses are thriving or closing. Observing what is happening in the community can tell you what to expect when it comes to home values.

Look into the school district – Even if you don’t have children, the school district is an important factor if you ever decide to sell your home. According to an article by the NY Times, many economists estimate a 5% improvement in test scores can increase home prices by 2.5% percent in the suburbs.

So you’ve found the home of your dreams, now it is time to submit an offer and sign the contract agreement with the sellers. Your real estate agent will help you put together your offer. In some cases, other people will be putting in offers on the home, which can result in a bidding war. Keep calm and work with your real estate agent to put your best foot forward.

You will also need to negotiate the terms of your purchase agreement, such as the purchase price, items to be left in the home, seller assistance, etc. These negotiations can get intense, but keep in mind you and the seller have the same goal. Sometimes you may need to compromise on the little details to move forward.

Buyers have a right to have a professional home inspection completed before they purchase the home. This inspection will help make you aware if there are any expensive repairs or structural issues prior to buying the home. If the inspector finds major issues, you can request that the seller fix them, reduce the price, or you can choose to cancel your contract.

If you’re getting a home loan, you will also need to have an appraisal done. The appraisal will evaluate the value of the home and prevent you from paying more than the home’s true value. Once this is done, you will need final approval on your mortgage. Your lender will look through the details of your finances and finalize your mortgage.

Once you complete all the steps above, it’s time to close! You will receive your closing documents to review prior to closing day. On the closing day, you will sign the paperwork and be a homeowner! You will need to pay for closing costs, prorated property tax, and homeowners insurance. Once you sign the paperwork, you will officially be a homeowner!

Congratulations on your new home! As the excitement calms down and you start unpacking your things in your new home, you may be wondering, now what? Here are a few tips to follow as you navigate being a new homeowner.

You’ve made a major investment in your home, so it is crucial to keep up with maintenance. With regular maintenance, you can decrease repair costs by fixing problems while they are small before they can grow into bigger, more expensive issues.

Owning a home can come with major surprise expenses. You may end up having to get a new water heater or replace the roof, so it’s important to be prepared. Start an emergency fund to help you cover these unexpected costs.

Don’t get caught up in what your home is worth right now. The value of your home will only matter when the time comes for you to sell it. The current market will not determine what your home is worth five or ten years down the road. A major determinant of how much you will profit from your home will depend on whether you are forced to sell due to financial issues or if you choose to sell for something like a job relocation.

At Gardner Moving, we know moving can be stressful and can be even more nerve-wracking for a first-time homeowner. When you work with Gardner Moving for all of your moving needs, you can rest assured that your items are in good hands. Our highly trained, professional staff is ready to assist you with the next chapter in your life! Contact us today to learn more about our moving services.